Personal finance refers to individuals and household consumption possibilities, both now and in the future, and is therefore driven by both income and wealth.

It can have a significant impact on people's sense of wellbeing and the financial situation of the population is an important aspect of national wellbeing.

The 5 measures in the Personal Finance domain are:

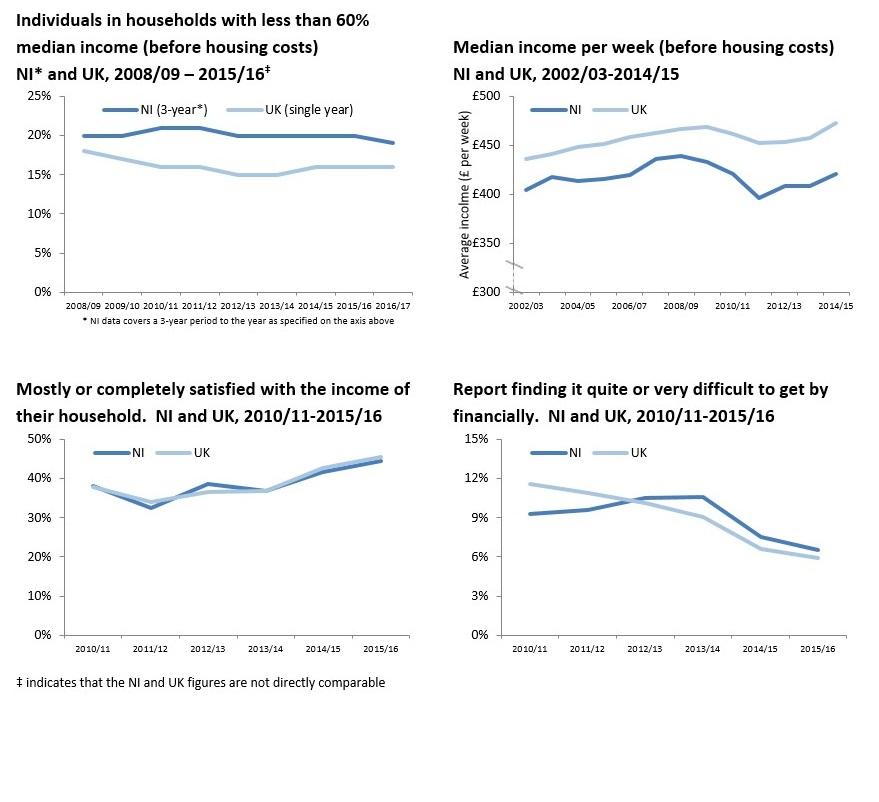

- Individuals in households with less than 60% of median income (before housing costs)‡

- Median wealth per household, including pension wealth – No NI Data Available

- Real median household income – No NI Data Available (FRS data for NI and UK presented below)

- Mostly or completely satisfied with the income of their household

- Report finding it quite or very difficult to get by financially

Latest findings

- At 19% (3 year average, 2014/15-2016/17), one in five individuals in Northern Ireland live in households with less than 60% of UK median income (before housing costs). In the UK overall in 2016/17, 16% of individuals were in relative low income (before housing costs). ONS report Northern Ireland information on a 3-year basis in their National Wellbeing release, however single year information and much more detail on Northern Ireland poverty levels is available in the Department for Communities Households Below Average Income Report.

- In Great Britain in 2014/16, median wealth per household data was £259,400. These data are sourced from the Wealth and Assets survey which is conducted in Great Britain only. There are no equivalent data for Northern Ireland.

- The UK estimate for Real Median Household Income is sourced from National Accounts (£27,310) and is not available on the same basis for Northern Ireland. However, comparable data from the Family Resources Survey shows that, in 2014/15, average weekly household income in Northern Ireland was £420 compared with £473 for the UK as a whole.

- The last two measures in the Personal Finance Domain are sourced from data from the Understanding Society Longitudinal Study. These data show that more than two-fifths of NI respondents in 2015/16 were mostly or completely satisfied with the income of their household. This was comparable with the UK generally. At 6.5% in 2015/16, the proportion of Northern Ireland respondents indicating that they were finding it quite or very difficult to get by financially was also similar to the UK overall (5.9%).

Do you want to know more? – Office for National Statistics Wellbeing.

10 National Wellbeing Domains

Personal wellbeing Our relationships Health What we do

Where we live Personal finance The economy